Pharmacy News | December 2023

Welcome to the winter edition of our quarterly newsletter

The future of community pharmacy

Nobody knows the future of community pharmacy and the right time to sell. As always, you should consider selling when there is no threat to your business that will affect its goodwill. You might decide to sell due to retirement, ill health or you are going into a new venture. We have seen goodwill values drop in the last 12 months or so due to corporate disposals and other distressed sales flooding the market. But it’s not all gloom and doom as equally, we have been extremely busy completing many deals over the last quarter. Most of the transactions have been to first time buyers, independents, small and medium size groups with a forward-looking plan to grow while the large multiples downsize.

We believe next year will present a good opportunity to exit, if you are looking to sell the business, as interest rates start to fall, cost of living crisis abate, and the banks start to lend proactively again.

Pharmacy First service

This service will launch on 31 January 2024 which will be a new advanced service and will replace the Community Pharmacist Consultation Service (CPCS). The pharmacies will receive a first initial fixed payment of £2,000 that can be claimed from December 2023 and a monthly fixed payment of £1,000 from February 2024 for pharmacy contractors who reach a minimum number of monthly clinical pathway consultations (from 1 consultation in February 2024 to 30 consultations from October 2024).

Community pharmacists should seize the opportunity and provide maximum amount of services that they possibly can, to increase sales and profits to mitigate the cost increases of the last couple of years. This will also increase the value of the business.

The Pharmacy Show 2023

The Pharmacy Show returned to the NEC Birmingham on 15th and 16th October 2023. Over the course of two days, there were over 8,500 pharmacy professionals attending the show and over 300 exhibitors. A highlight of the show, an automation system (robotic) whereby even a small pharmacy

can invest into one model for hub and spoke which was previously only an option for larger groups. There is a whole host of affordable options that will allow you to automate those everyday tasks such as dispensing medication and managing stock levels etc.

Our joint stand with Silver Levene was located next to the Business Theatre where some excellent speakers with thought provoking ideas commented on the future of the pharmacy and new funding. Whilst exhibiting, we had numerous enquiries on selling and buying a pharmacy as well as pharmacists looking for an accountancy and tax advice. The show was a success, and we look forward to exhibiting again next year, our 17th year bar the covid years.

Pharmacy Valuations

If you are thinking of selling your pharmacy, we advise that you seek professional advice and valuation from a pharmacy expert or pharmacy sales agent. The valuation is determined by several factors to name but a few as a reminder: -

- EBITDA (Earnings before interest, tax, depreciation, and amortisation) profits – this is a preferred measure to value pharmacies and bank’s valuer will do the same.

- Financial information – Accounts, FP34s, VAT returns should be up to date.

- Location – pharmacies located in a health centre or next door to a surgery will still fetch abetter price, if there is more footfall too.

- Lease and rent – ensure there is at least 10 years left on the lease and is renewable. A very high rent will be a detriment to sale, buyers will account for any future rent and increases.

- Staff costs – high staff and locum costs will reduce the value of the pharmacy.

- NHS/OTC/services/wholesale/online/export sales – please ensure that these are analysed separately in the accounts.

- Growth potential – for example if you are not doing many of the services, the buyer will see this as an opportunity to enhance business and this is an attractive proposition for the buyer.

Interest rates and buyers’ appetite

The banks have maintained the level of lending appetite despite the rise in interest rates and economic pressures. We are pleased to report that most of our recent completion were to first time buyers which leads us to believe that they have a strong desire to acquire good, solid and profitable businesses. To facilitate their lending, many of the banks that are active in the pharmacy market are seeking increased due diligence, business plans, personal guarantee etc.

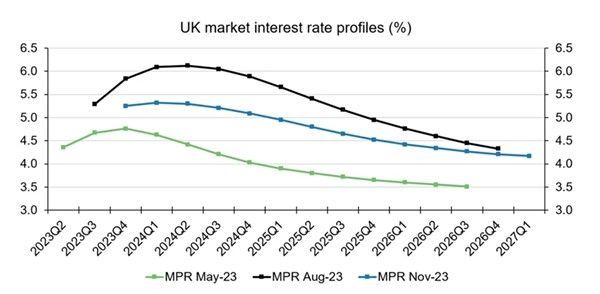

The table below shows interest rates at their peak, and the prediction for 2024 through to 2027 (source Bank of England).

Other news

We have been busy attending the Chemist + Druggist, Pharmacy Business and AIMp awards as well as exhibiting at The Pharmacy Show. It was nice to see our clients, prospects, colleagues and many familiar faces within community pharmacy attending those events. We look forward to attending the

same next year.

Thinking of selling or buying?

If you would like a free valuation or talk about how you could achieve a fantastic price for your pharmacy, please do contact us on our direct dial numbers: 020 7380 3446 or 020 7380 3424 and ask for Sanja or Diana in the first instance. We would welcome the opportunity to have a chat with you.

Alternatively, if you would like to buy a pharmacy, need accounting, or tax advice through our associated company Silver Levene, please also contact us on the same numbers. Your query will be directed to the right person.

Finally, we wish you a Merry Christmas, and a Happy, Healthy and Peaceful New Year. We look forward to talking to you soon.

This article is based on current legislation and practice and is for guidance only. Specific professional advice should be taken before acting on matters mentioned here. Should you require any advice please do not hesitate to contact us.